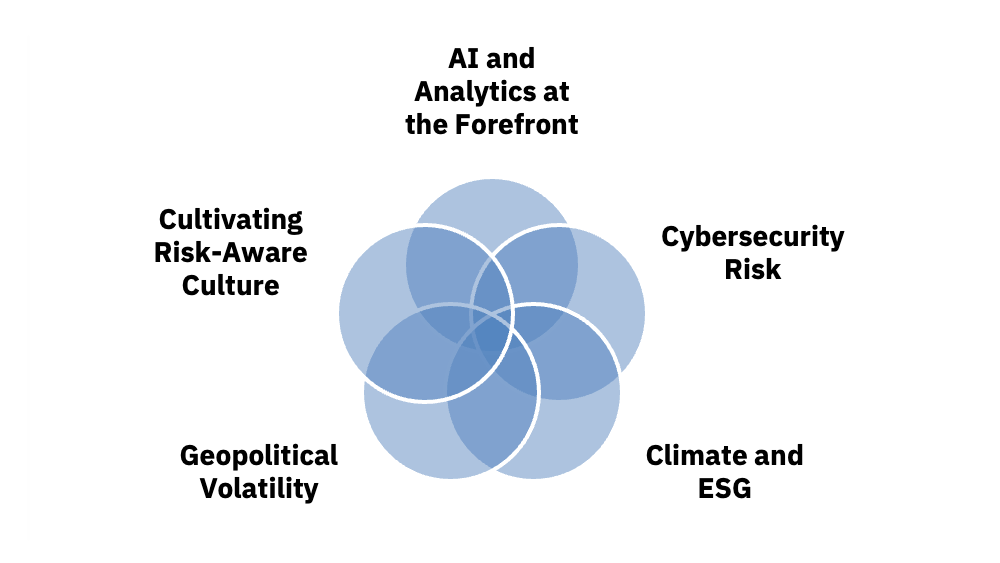

Home|Five Critical Trends Reshaping Enterprise Risk Management in 2025

As we advance through 2025, the risk management landscape continues to evolve at an unprecedented pace. For organisations operating in today’s complex global environment, understanding and adapting to these emerging trends isn’t just advantageous, it’s essential for survival and growth. Drawing from our extensive experience by supporting our clients in high-risk operational environments worldwide, NSSG Global highlights the five pivotal trends that are fundamentally reshaping how enterprises approach risk management.

Artificial intelligence and advanced analytics are revolutionising risk management from reactive to predictive. The data are compelling: by 2025, 70% of risk managers will place AI at the center of their strategy. according to Deloitte research, whilst PwC reports a remarkable 35% year-on-year growth in AI adoption within risk management frameworks.

This shift represents more than technological advancement, it’s a fundamental reimagining of how organisations identify, assess, and respond to threats. AI-powered risk intelligence enables companies to spot emerging risks faster, analyse complex data patterns, and predict potential disruptions before they materialise.

The NSSG Perspective: Our experience in complex operational environments has shown that the most effective AI implementations combine sophisticated algorithms with human expertise. Organisations must invest in both technology and talent, ensuring their teams can interpret AI insights within the broader context of their operational reality.

Actionable Framework:

Cyber risks have evolved beyond isolated IT concerns to become integral threats affecting supply chains, vendor relationships, and daily operations. The scale of this challenge is staggering: global cybercrime costs are projected to reach £8.2 trillion annually by 2025, according to Cybersecurity Ventures, whilst the World Economic Forum’s Global Risks Report reveals that 60% of organisations now rank cyber risk as their primary concern.

This interconnectedness means that a cyber incident can cascade through an organisation’s entire ecosystem, affecting partners, suppliers, and customers simultaneously. Traditional perimeter-based security approaches are no longer sufficient in this environment.

The NSSG Approach: Effective cybersecurity risk management requires a holistic view that encompasses not just technology, but people, processes, and partnerships. Our methodology emphasises building resilience across the entire value chain, not just within organisational boundaries.

Strategic Considerations:

Environmental, Social, and Governance (ESG) factors have transitioned from regulatory compliance issues to core business risks that directly impact operational continuity and financial performance. A striking 90% of executives believe climate risk will directly impact their business within the next five years, according to EY research, whilst ESG-related investments have surpassed £27.3 trillion globally in 2024, as reported by Bloomberg.

Climate risks now influence everything from supply chain stability to regulatory compliance, insurance costs, and stakeholder expectations. Organisations must integrate climate and ESG considerations into their fundamental risk management frameworks.

NSSG’s Integrated Methodology: Our approach treats ESG risks as operational realities rather than abstract concepts. We help organisations identify specific climate-related threats to their operations, develop adaptation strategies, and create measurable resilience indicators.

Implementation Strategy:

Geopolitical instability has become a persistent feature of the global business environment, demanding sophisticated resilience planning. KPMG research indicates that 72% of CEOs expect geopolitical instability to disrupt their supply chains in 2025, whilst the World Bank reports a 45% increase in global trade disruptions over the past three years.

These disruptions extend beyond traditional conflict zones, affecting global supply chains, regulatory environments, and market access. Organisations must develop capabilities to navigate this complexity whilst maintaining operational effectiveness.

NSSG’s Global Expertise: Our two decades of experience operating in complex geopolitical environments provides unique insights into building organisational resilience. We understand that effective geopolitical risk management requires both strategic foresight and tactical adaptability.

Resilience Framework:

The most critical trend is the recognition that effective risk management depends fundamentally on organisational culture. Companies with strong risk cultures are 2.5 times more resilient during crises, according to McKinsey research. However, a concerning 65% of employees report lacking adequate training to identify risks, as revealed by Protiviti’s survey.

Building a risk-aware culture requires more than policies and procedures—it demands embedding risk consciousness into decision-making processes at every organisational level.

NSSG’s Cultural Transformation Approach: We’ve observed that the most resilient organisations treat risk awareness as a core competency, not a compliance requirement. This involves creating environments where employees feel empowered to identify and report potential risks without fear of blame.

Culture Development Strategy:

As we’ve examined these five trends, a clear pattern emerges: risk management in 2025 needs to become “proactive, digital, and human-centred.” The organisations that will thrive are those that embrace this evolution, combining advanced technology with human insight and organisational culture.

The convergence of these trends creates both challenges and opportunities. Whilst the risk landscape becomes more complex, the tools and methodologies for managing these risks are becoming more sophisticated and effective. Organizations which will embed a risk management culture will be better equipped to exploit opportunities.

For organisations seeking to enhance their risk management capabilities:

The risk management landscape of 2025 demands a new level of sophistication, integration, and agility. Organisations that recognise and adapt to these trends will not only survive but gain significant competitive advantages in an increasingly uncertain world.

NSSG Global has been helping organisations navigate complex risk environments for over two decades. Our expertise in AI-powered risk intelligence, geopolitical analysis, and crisis management enables clients to transform challenges into competitive advantages. To learn more about how these trends might affect your organisation, contact our risk management specialists for a confidential consultation.